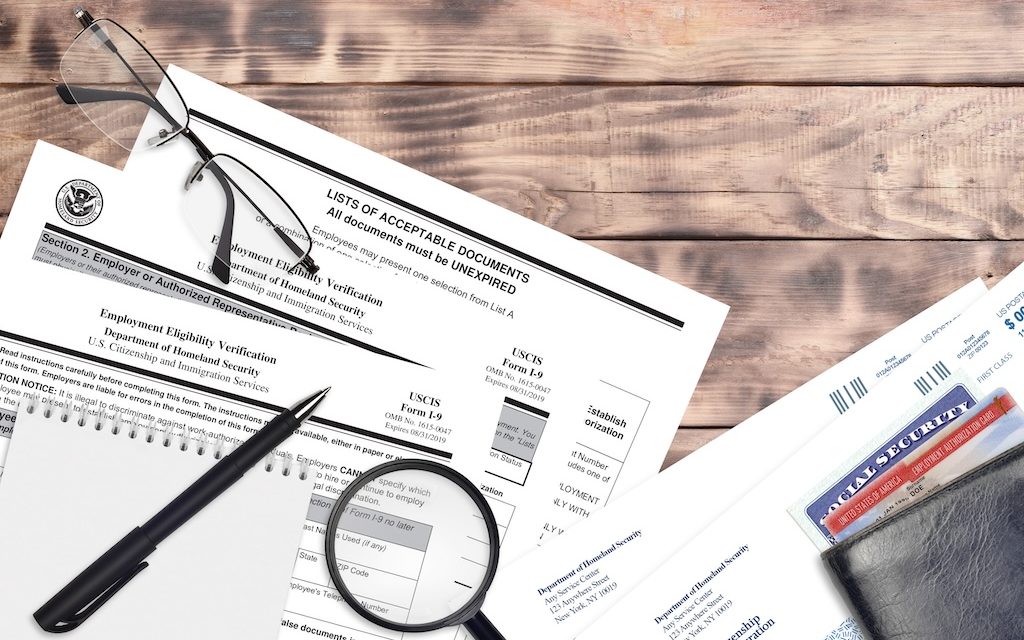

U.S. Citizenship and Immigration Services (USCIS) uses Form I-9 to verify an individual’s identity and employment authorization. Employers and new hires complete the form to comply with the Immigration Reform and Control Act of 1986 (IRCA).

New hires must provide acceptable documentation to verify their identity and eligibility to work in the country. Failure to properly complete and file an I-9 can result in civil monetary penalties for the employer.

Sections of Form I-9

The sections of Form I-9 include:

- Section 1. Employee Information and Attestation, completed by the new hire

- Section 2. Employer Review and Verification, completed by the employer or an authorized representative

- Supplement A, Preparer and/or Translator Certification for Section 1, completed by any preparer and/or translator who assists a new hire in completing Section 1

- Supplement B, Reverification and Rehire, completed by employers if an employee requires re-verification, is rehired within 3 years of the date the original Form I-9 was completed, or provides proof of a legal name change

New hires must provide acceptable documentation verifying their identity and US employment authorization:

List A documents

List A documentation establishes the new hire’s identity and employment authorization. Any of the following are acceptable:

- U.S. passport or U.S. passport card

- Permanent Resident Card or Alien Registration Receipt Card

- Foreign passport containing a temporary I-551 stamp or temporary I-551 printed notation on a machine-readable immigrant visa

- Employment Authorization Document containing a photograph

- Foreign passport with Form I-94 or Form I-94A with Arrival-Departure Record containing an endorsement to work

- Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with Form I-94 or Form I-94A indicating nonimmigrant admission under the Compact of Free Association Between the United States and the FSM or RMI

List B documents

List B documentation establishes the new hire’s identity. Any of the following are acceptable:

- Driver’s license or ID card issued by a State or outlying possession of the United States that contains a photograph or information such as name, date of birth, gender, height, eye color, and address

- ID card issued by federal, state, or local government agencies or entities that contains a photograph or information such as name, date of birth, gender, height, eye color, and address

- School ID card with a photograph

- Voter’s registration card

- U.S. Military card or draft record

- Military dependent’s ID card

- U.S. Coast Guard Merchant Mariner Card

- Native American tribal document

- Driver’s license issued by a Canadian government authority

New hires who present one of these documents also must provide a document from List C for Section 2.

List C documents

List C documentation establishes the new hire’s employment authorization. Any of the following are acceptable:

- U.S. Social Security Card

- Certification of report of birth issued by the Department of State

- Original or certified copy of birth certificate issued by a State, county, municipal authority, or territory of the United States bearing an official seal

- Native American tribal document

- U.S. Citizen ID Card

- Identification Card for Use of Resident Citizen in the United States

- Employment authorization document issued by the Department of Homeland Security (DHS)

Importance of Form I-9 Compliance in Staffing

A staffing firm is required to comply with Form I-9 requirements for each person hired to work in the United States:

- The firm can complete and submit the form either on the date a new hire enters the assignment pool or on the date they are assigned to their first job.

- The chosen date must be consistent for all new hires because it indicates the first day of employment.

- A standardized date is essential if the staffing firm is audited by Immigration and Customs Enforcement (ICE).

Rules for completing Form I-9

Keep these rules in mind when completing Form I-9:

- A new hire can complete Section 1 only after they accept an offer to join the staffing firm.

- Section 1 must be completed no later than the date chosen in Section 2.

- Section 2 must be completed no later than the third business day after the date entered.

Expiration dates for Form I-9

The latest Form I-9 has an edition date of 08/01/2023 and an expiration date of 05/31/2027. Staffing firms may use forms with an expiration date of either 07/31/2026 or 05/31/2027 until the expiration date. Updates to expired forms are due by July 31, 2026.

Staffing Firm Challenges with Form I-9

Many staffing firms face the following challenges in complying with Form I-9 requirements:

- Staying current with I-9 requirements

- Conducting company-wide human resources training on consistent and compliant processes

- Hiring large volumes of employees

- Employing temporary, seasonal, and contingent workers

- Managing high turnover rates

- Maintaining multiple hiring locations with a displaced workforce

- Managing and tracking I-9s for each employee, client, and location

Challenges with remote I-9 verification

Staffing firms participating in E-Verify can face additional challenges with remote I-9 verification:

- Training human resources in complex document requirements

- Avoiding discrimination during the document review process

- Organizing logistics to meet the in-person document inspection requirements

- Accurately completing each section of the I-9

- Meeting government deadlines

- Managing and keeping track of I-9s for multiple work sites

Considerations for remote I-9 verification

E-Verify is an internet-based system allowing employers to electronically confirm new hires’ identity and employment eligibility by comparing information from their Form I-9 with records available to the U.S. Department of Homeland Security and the Social Security Administration. Staffing firms must follow these requirements for remote Form I-9 verification:

- Staffing firms may designate, hire, or contract with any person, known as an authorized representative, to complete, update, or correct Sections 2 or 3 on their behalf.

- Section 2 must be completed within 3 business days from the date work for pay begins.

- The person who examines the original, unexpired documents in the new hire’s presence must fill out, sign, and date Section 2 of the I-9.

- The staffing firm is liable for any errors, potentially leading to costly fines and penalties.

Recordkeeping for Form I-9

Properly completing and filing Form I-9s is essential for staffing firms. Otherwise, an audit from a federal agency such as ICE can lead to costly penalties for noncompliance.

Staffing firms must retain I-9s for 3 years after an employee’s first day of work or 1 year after the employee is terminated, whichever is later. Internal audits ensure the forms are correctly completed and filed to avoid noncompliance penalties.

Since federal I-9 audits are increasing, staffing firms are encouraged to conduct regular internal audits to resolve potential issues. Hiring employees not legally eligible to work in the U.S. can result in costly penalties, fines, and loss of ability to operate as a business.

Compliance Tips for Form I-9

These tips help staffing firms maintain compliance with Form I-9 requirements and avoid costly penalties:

- Train Human Resources: Ensure the team understands and follows I-9 compliance requirements, including proper completion, filing, and retention.

- Monitor re-verification deadlines: Implement a system to track and update expiring I-9s.

- Conduct internal audits: Regularly review I-9s to identify and correct any errors.

Strategies for Avoiding Form I-9 Penalties

These strategies help staffing firms avoid costly Form I-9 penalties:

- Develop simple processes: Create easily understood processes for completing an I-9. Include information about the documentation needed to complete the form.

- Train Human Resources: Regular training and regulation updates ensure employees understand the I-9 processes. Provide an I-9 audit checklist to maintain compliance.

- Use I-9 software: Choose software based on the staffing firm’s needs. Focus on the ease of use and potential impact on efficiency and productivity.

- Audit I-9 processes: Ensure processes are the same for each new hire. Focus on whether the firm has I-9 errors, how they are resolved, and employee awareness of noncompliance penalties.

Sources:

- https://mitratech.com/resource-hub/blog/i-9-for-staffing-agencies-top-3-things/

- https://www.gryphonhr.com/form-i9-considerations-for-staffing-agencies

- https://www.onblick.com/blogs/what-is-form-i-9-and-how-to-stay-compliant-with-i-9

- https://www.hrlogics.com/rising-i-9-penalties-critical-compliance-strategies-for-2025

- https://workbright.com/blog/i-9-penalties/